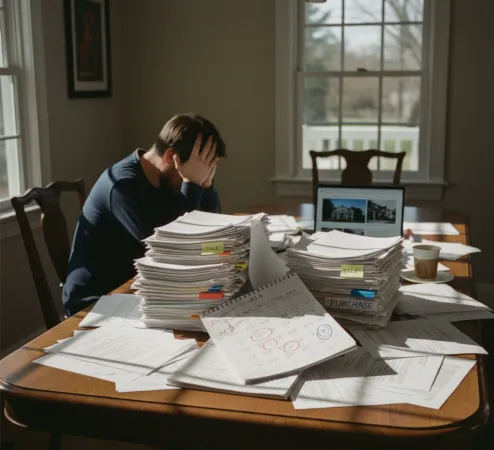

The Emotional Rollercoaster of Buying & Selling at the Same Time

Buying and selling a home at the same time is one of the most stressful moves you can make — especially in Connecticut.

You've seen the houses online. You know what you want. You're ready to move.

But there's a problem: you have to sell your current home to buy the new one.

Suddenly, you're on a rollercoaster.

What if you sell too early and end up homeless? What if you can't sell fast enough and lose your dream home? What if everything falls apart at the last second?

The fear is real. The stress is real.

But here's what most people don't understand: the rollercoaster isn't caused by bad luck or bad timing.

It's caused by missing structure.

When you try to buy and sell at the same time without a system, emotion takes over. You make rushed decisions. You overpay. You settle. You lose sleep.

Dream to Doorstep is the system that gets you off the rollercoaster. It shows you exactly what to do, when to do it, and what happens if something goes wrong—before it goes wrong.

1. Why Buying and Selling Simultaneously Breaks People

Buying and selling at the same time introduces linked risk: one deal depends on the other, timing rarely lines up perfectly, and failure on one deal can blow up both.

The fear comes from three places:

Fear of being displaced — What if you sell your home before you find a new one?

Fear of affordability — What if you discover too late that you can't afford what you thought you could?

Fear of the unknown — What happens next? What if the inspection fails? What if the appraisal comes in low? What if your buyer's financing falls through?

When you don't have a system, fear leads to panic. Panic leads to bad decisions.

In Connecticut, the average home sells for 102.5% of asking price (SMARTMLS Data, November 2024)—meaning buyers are routinely bidding above list just to compete.

Without clear strategy, buyers often face:

Overpayments due to rushed decisions in competitive situations

Restarting the entire home search or extending closing timelines when contracts fall apart

Temporary housing costs if timing doesn't align

Sleepless nights wondering if you'll have a home to live in

These aren't worst-case scenarios. These are predictable outcomes when structure is missing.

2. Why Generic Advice Fails

Most advice about buying and selling at the same time sounds reasonable at first:

"Wait for the market to turn"

"Interest rates are going to come down—then prices will drop and inventory will increase"

"Wait for the spring market"

"Get your house listed and then we'll figure out your next home"

These sound logical. They're not.

"Wait for the market to turn"

Timing the market never works. Markets don't turn on predictable schedules. Meanwhile, your family is outgrowing your house, your commute is killing you, or you're missing the school enrollment deadline. Move when it's right for your situation, not when you think the market hits some perfect point.

"Interest rates are going to come down—then prices will drop and inventory will increase"

This is timing the market AND it's wrong about cause and effect. Lower interest rates might convince some people to sell, but they'll definitely convince more people to buy. More buyers plus the same (or slightly higher) inventory equals more competition and higher prices. You end up waiting for conditions that make your situation worse, not better.

"Wait for the spring market"

Same problem. Timing the market doesn't work whether you're buying or selling. Spring might bring more inventory, but it also brings more competition. You're guessing about conditions months away while your current situation demands action now.

"Get your house listed and then we'll figure out your next home" (or the reverse)

This is the most dangerous advice because it sounds practical. But handling one side without coordinating the other is how people end up homeless, paying double mortgages, or making panic decisions.

Here's what that looks like in practice:

A couple called me last week about one of our rental properties. They sold their home and were closing in 3 weeks.

They have four kids and pets.

They couldn't find another house to buy or a rental that worked for their family.

Our property was too small.

They are still frantically searching with the clock ticking.

This is a massive failure by their agent—and it started with "list your home first, we'll figure out the rest later."

3. The Strategy Landscape — What's Actually Possible

You can't know which strategies work for you without mapping out your situation first. That's what Dream to Doorstep Steps 1-3 do: establish where you are, what you need, and which options are both viable and acceptable to you.

Here's the landscape of what exists:

There are only three real approaches: Compete, Coordinate, or Decouple.

Equity-Based Compete Tools (HELOC / Bridge Loan / Cash Purchase Program)

How they work:

These tools use your current home's equity to fund the down payment on your new home before selling. Options include HELOCs (home equity lines of credit), bridge loans, and cash purchase programs. Each has different qualification requirements, costs, and timelines. The right one depends on your income, credit, and equity position.

Costs:

Range from $3,000 to $15,000 depending on the tool, loan amount, and how long it takes your current home to sell.

Works best when:

Hot markets where contingent offers get rejected

You have 25%+ equity in your current home

You have good credit and stable income (qualification varies by tool)

Doesn't work when:

Slower markets where contingent offers are commonly accepted (the cost isn't worth it)

Insufficient equity or damaged credit

Risk:

You're carrying the loan balance until your current home sells. If it takes longer than expected, interest costs and fees can accumulate.

CATEGORY 2: COORDINATE STRATEGIES

These strategies accept that you can't remove the "must sell first" requirement, but they manage timing and protect you from losing housing or getting stuck.

Hubbard Clause (Purchase Depends on Selling Current Home)

How it works:

Your purchase offer includes a clause that says the contract depends on your ability to sell your current house. The contract details timing, price, and any other terms of the contingency.

Costs:

No direct cost, but your offer is less competitive than non-contingent offers.

Works best when:

Slower markets where sellers have fewer options

Unique or expensive properties with smaller buyer pools

Patient sellers willing to wait

Doesn't work when:

Hot markets with multiple competing offers

Sellers need certainty and speed

Risk:

The seller can keep marketing the property, accept backup offers, or cancel the contract if your timeline runs out. You could lose the home while waiting for your current home to sell.

"Must Find Suitable Housing" Clause (Sale Depends on Finding Replacement)

How it works:

You list your home with a contract clause that says the contract depends on your ability to find suitable housing. The contract details timing, price, and any other terms of the contingency.

Costs:

No direct cost, but fewer buyers (some avoid listings with conditions).

Works best when:

Hot market for your home (you have leverage with buyers)

You need time to find housing without being rushed

Doesn't work when:

You're buying in a hot market (hard to win offers when you still have your own condition active)

Buyers in your area avoid contingent listings

Risk:

Legal problems if the clause isn't written correctly. An offer on a new house may still need to be contingent on the sale of your existing house, even if that house is already under contract.

CATEGORY 3: DECOUPLE STRATEGIES

These strategies separate the buy and sell deals completely, removing time pressure and giving you maximum flexibility.

Temporary Housing (Sell First, Then Buy)

How it works:

You sell your home and move into temporary housing while you search for your new home without time pressure. Options include renting an apartment (month to month or longer leases possible), negotiating a rent-back from your buyer (typically 30-90 days), or staying with family/friends (duration TBD). Each has different costs and tradeoffs.

Costs:

Range from $0 (staying with family) to $25,000+ (long-term rental). Rent-back typically costs the buyer's mortgage payment plus $200-$500/month. Moving twice adds $2,000-$4,000.

Works best when:

Any market (you're not tied to conditions when you're ready to buy)

You have strong family relationships willing to host (for family option)

You find a buyer willing to accommodate rent-back

Doesn't work when:

Tight budget can't absorb rent costs

No local family/friends able to accommodate you

Risk:

Rent costs accumulate if your search takes longer than planned. Rent prices may increase during your search period. For rent-backs, you may have to move twice if your search takes too long and attorneys often do not like the liability risk. For family stays, relationship strain may force you to rush your purchase decision.

Blended Approaches

These strategies can be combined based on your specific situation. For example, you might use a Hubbard clause on the home you're buying while including a "Must Find Housing" clause on the home you're selling. Or you might make a "cash-backed" offer then push to get your conventional financing approved in time so you don't need to incur the fees related to the "cash-backed" offer.

The right combination depends on your specific situation—which is what Dream to Doorstep is designed to figure out.

4. Where Dream to Doorstep Fits

Dream to Doorstep is a six-step system that takes you from "I need to buy and sell at the same time" to "both deals closed, keys in hand, zero chaos." Here's how it works:

Step 1: You Are Here

Before you can pick a strategy, you need to know where you're starting from.

Step 1 establishes:

Your financial situation

Your timeline and priorities

Who makes decisions and whether everyone agrees

What this prevents:

Wasted time searching for houses outside your price range

Lost dream homes because of conflicting priorities

Disruptions from surprise decision-makers (like parents or in-laws who show up mid-process with opinions)

Step 2: Define Your Dream

Once you know where you are, you need to know where you're going—and what's flexible versus non-negotiable.

Step 2 clarifies:

Must-have needs on both the buy side and sell side

Flexible wants that can adjust based on market reality

What this prevents:

Wasted time searching for the wrong house

Buyer's remorse because you didn't vet your requirements before committing

Step 3: Tailored Strategy

Now we match your Step 1 reality and Step 2 goals to strategy options, filtered by current market conditions.

Step 3 selects:

Which strategies apply to your situation

Which strategies are viable in current market conditions

Which specific tools are acceptable to you

What this prevents:

Failures from one-size-fits-all approaches

Excessive stress and disappointment because you didn't understand market conditions

Cold feet from using a strategy you do not agree with

Step 4: Overwhelming Offer

Whether you're buying or selling (or both), Step 4 is about crafting the offer with the best chance to win.

On the buy side: your offer is crafted using as many of the 20+ levers in Dream to Doorstep as possible to convince the seller you are the Best Buyer.

On the sell side: your offer to the market (your listing) is designed to maximize number of offers from buyers while achieving your goals (price, timeline, other terms).

What this prevents:

Lost deals because your offer was weak

Overpaying on price when other terms would have won

Stress and frustration from unattractive offers

Lowball offers or no offers on your home

Step 5: Contract to Closing Concierge

This is where most simultaneous transactions fall apart—and where Dream to Doorstep earns its keep.

Timeline tracking across both contracts simultaneously

Coordination of lenders, attorneys, inspectors, appraisers on both sides

Early identification of conflicts (key date delays, inspection issues, appraisal problems)

Proactive solutions before deadlines hit

What this prevents:

Stress and frustration from missed deadlines

Unanticipated problems and poor planning

Stress from poor communication and fear of the unknown

Step 6: Beyond the Doorstep

Your move is complete, but support doesn't end.

Step 6 provides:

Ongoing access for questions, service provider recommendations, and problem-solving

Home value tracking so you know your equity position for future decisions

Future planning support when life changes again

5. Three Principles That Change Everything

Buying and selling at the same time is manageable. Some people do it without a system and get lucky. But most don't.

The difference between smooth closings and chaos comes down to three principles:

Principle 1: Preparation Is the Key to Less Stress and Faster Results

A sports team that practices and prepares is more likely to win. Real estate works the same way.

The buyers who let house after house slip by without making an offer, who get cold feet after talking to family, who can't decide what they actually want? They skipped preparation. They're discovering their budget limits in real-time, figuring out what matters through disappointment, and letting external opinions override their own decision-making because they never established a framework.

The buyers who make 2-3 offers and close in 60 days? They did the work up front. They knew their real numbers, understood their constraints, and had a strategy before they looked at a single house.

Preparation doesn't guarantee perfection. But it keeps you from:

Losing the house you wanted because you couldn't decide fast enough

Wasting months touring homes that were never going to work

Backing out of deals because you let your brother-in-law talk you out of it

Principle 2: The Market Does Not Care About Your Opinions

You can believe the market is overpriced. You can think interest rates should be lower. You can wish there were more homes for sale.

The market doesn't care.

Ignore market conditions at your own risk. If it's a hot market and you insist on using a Hubbard clause because it "should" work, you'll lose. If it's a slow market and you pay fees for a cash-backed offer you don't need, you'll waste money.

Respecting the market means adapting your strategy to reality, not attempting to bend reality to match your expectations.

Principle 3: Having Options Makes the Process Easier

The fear in simultaneous transactions comes from not knowing what happens next.

When you know what's possible—and more importantly, what's possible for you—you take back control.

You can't eliminate risk. But you can eliminate the unknown.

Knowing your options means:

Understanding which strategies exist

Knowing which ones you qualify for

Having backup plans if the first approach fails

Options don't make the market easier. They make you more capable of handling whatever the market throws at you.

Closing

Buying and selling at the same time is manageable—but only when it's treated like the complex problem it actually is.

Confidence doesn't come from hoping for the best.

It comes from a system that can handle shocks.

If you want the strategy for your exact situation…let's build the plan.