Step 5: Contract to Closing Concierge—How One Weak Attorney Nearly Caused a Double Foreclosure

Most buyers think the hard part is getting the offer accepted.

It isn't.

The hard part is everything that happens after—the deadlines, the inspections, the mortgage conditions, the legal work, and all the hidden disasters that can blow up a deal without warning.

This is where most deals die.

Step 5—Contract to Closing Concierge—is the difference between "Welcome home" and "Sorry, the deal fell through."

Here's what happens when you don't have the right team protecting you.

Four Months, Two Foreclosures, and One Attorney Who Didn't Do Her Job

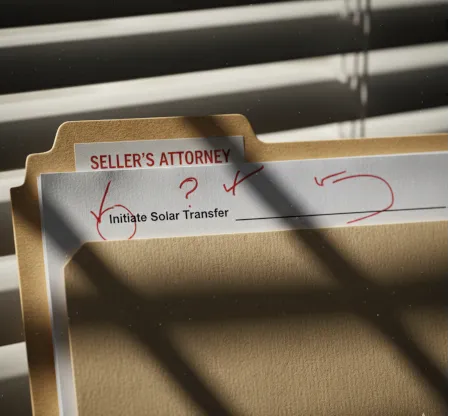

Ted and his wife Nancy were shopping for a rental property in Bridgeport, CT. They had financing ready, strong reserves, and found a legal two-family with an accessory building. Sellers lived in both units. The property had leased solar panels that needed to be transferred to the buyers.

Everything looked straightforward.

We went under contract in July.

That's when the trouble started.

The seller's attorney refused to initiate the solar lease transfer—even though the seller's agreement legally required her to do it. My client's attorney and I told her several times. She insisted it was the buyer's responsibility.

Five weeks went by. She finally contacted the solar company.

And learned the company had filed for bankruptcy the week before.

All transfers were frozen. No exceptions. No timeline.

We were stuck. Couldn't close. Couldn't transfer the solar lease. Couldn't do anything except wait for bankruptcy court.

Then it got worse.

During the four-month delay, the sellers stopped paying both the solar lease and their mortgage. Now they were facing two foreclosure actions at the same time.

It took:

Negotiations with the bankruptcy attorney

Work related to both foreclosure proceedings

Repeated contract extensions

Daily communication

We finally closed in November.

Four months late.

All because the seller's attorney refused to submit a form in July.

If Ted didn't have a top-tier real estate attorney—Joe Schettino—this deal would have died in August.

The $10K Repair That Turned Into $40K—And Still Closed

Eliza and her family were renting. Good income and credit. She found a house that seemed to need around $10K in FHA repairs. Nothing major.

We got under contract. I was in Europe when the deal came together. When I returned for the inspection, the truth hit us:

The house needed $40,000 in repairs—not $10K.

Two problems immediately surfaced:

The home was under contract as-is.

Eliza's reserves couldn't support another $30K in costs.

Most agents freeze here. Most deals fall apart.

Here's what we did:

I pushed the limits of the "as-is" clause, knowing the worst case was Eliza walking away from an overpriced property.

We negotiated a $35K price reduction, dropping the price from $325K to $290K.

Then we structured a renovation loan covering the $40K in repairs.

Net result: Eliza saved $5K compared to the original price and got the home fully renovated.

But there was one more landmine.

The lender flagged her reserves. They'd tightened because of normal purchases—furniture, unexpected costs—during the process.

If she had spent any more, the deal would have died in underwriting.

Critical lesson: Don't spend significant money during the home buying process without speaking with your lender first.

The renovation loan closed in 30 days. Most lenders can't close a standard conventional loan that fast—let alone a renovation loan that requires contractor quotes, additional bank approvals, and extra inspections.

That only happens with a team that knows the process cold.

The Three Negotiation Windows After You're Under Contract

Most buyers think negotiation ends when the offer is accepted.

It doesn't.

There are three major negotiation windows after contract execution:

Window 1: Initial Contract

This is where you got the house.

Window 2: Inspection

If the inspection uncovers problems, we renegotiate.

Even in an "as-is" sale, undisclosed issues can change the terms.

That's exactly what happened with Eliza. "As-is" didn't mean we couldn't push back when the problems were 4X worse than expected—she saved $5K because we knew how to negotiate it.

Window 3: Appraisal

If the appraisal comes in low, we negotiate price or structure again.

Each of these windows can save you thousands—or cost you thousands if handled poorly.

That's not something you want to learn on the fly.

Timeline Management: The Work Buyers Never See

Every CT real estate transaction has a chain of deadlines:

Earnest money deposit

Inspection contingency

Appraisal

Mortgage commitment

Title work

Homeowner's insurance

Final walk-through

Closing coordination

Some deadlines are flexible. Others are "time is of the essence" where missing the date means you forfeit your earnest money deposit—typically $5,000-$10,000 in Connecticut.

Because of the solar bankruptcy, Ted's deal required multiple extensions and constant negotiation to prevent either side from walking away.

Without active timeline management, deals die.

The Walk-Through: Your Last Line of Defense

The final walk-through happens right before closing. It's the buyer's last chance to confirm the property condition matches the contract terms.

If something's wrong, we address it before closing—not after you own the home.

I’ve seen everything from flooded basements (pipe burst morning of closing) to repairs not complete and items gone that were supposed to be left behind (refrigerator - two different deals…).

We attend closings to handle any last-minute issues while you focus on signing.

What Comes Next

Most agents disappear after closing.

That's exactly when new homeowners run into problems:

Utilities

Contractors

Billing surprises

Insurance questions

Mailbox issues

Tension with neighbors

Early maintenance problems

Dream to Doorstep doesn't end at the door.

You live your life. We protect your home.

The next phase covers everything that comes after closing.

Next up: Step 6—Beyond the Doorstep (The Support That Never Ends).